Speed wins you freight. Inbox overload loses it.

Front turns your inbox into an AI-powered command center. Manage quotes, shipment updates, and carrier coordination in one workspace, so your team can respond faster and win more freight.

Outlook can’t handle your complex workflows. Front can.

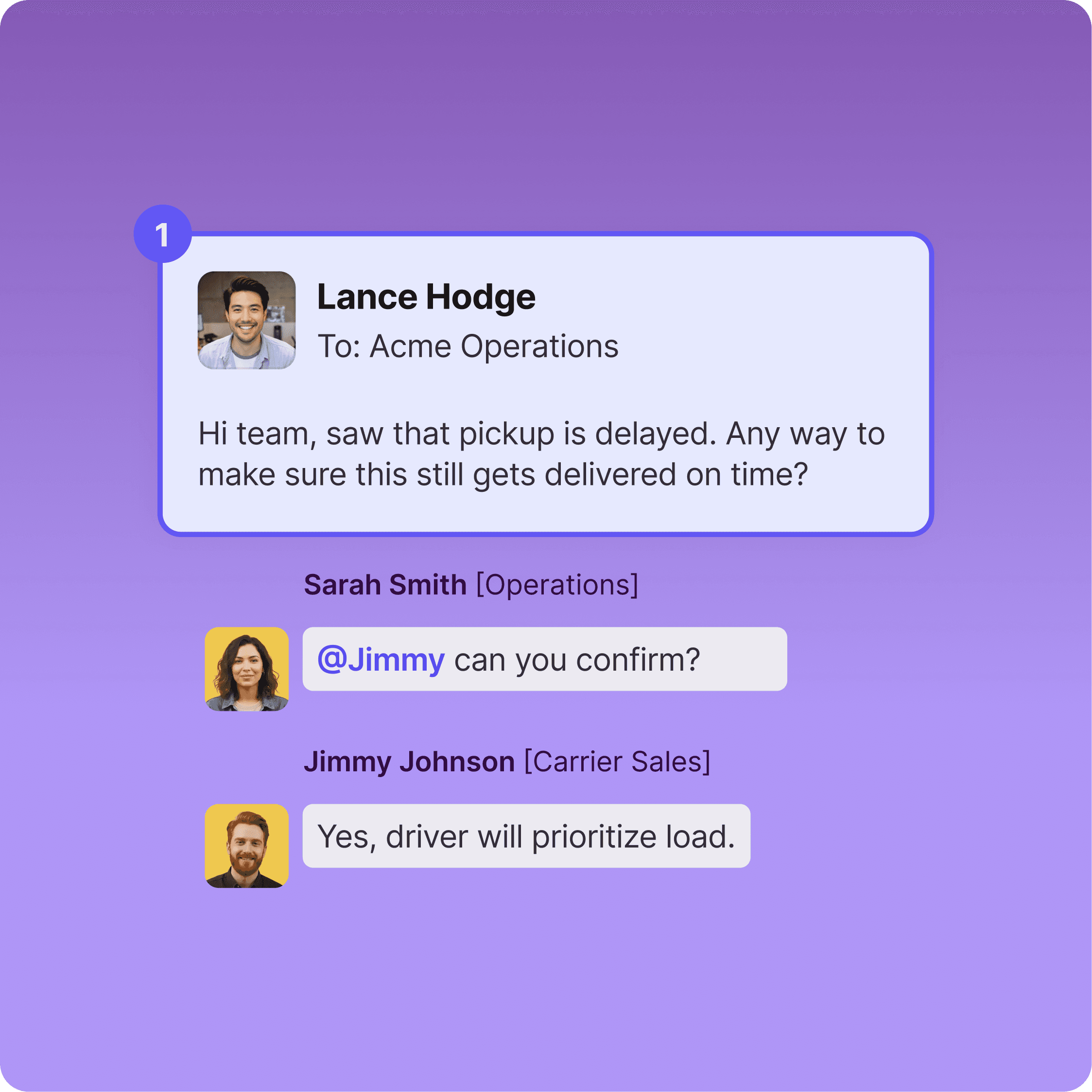

See all communication and context in one place, so nothing slips through the cracks.

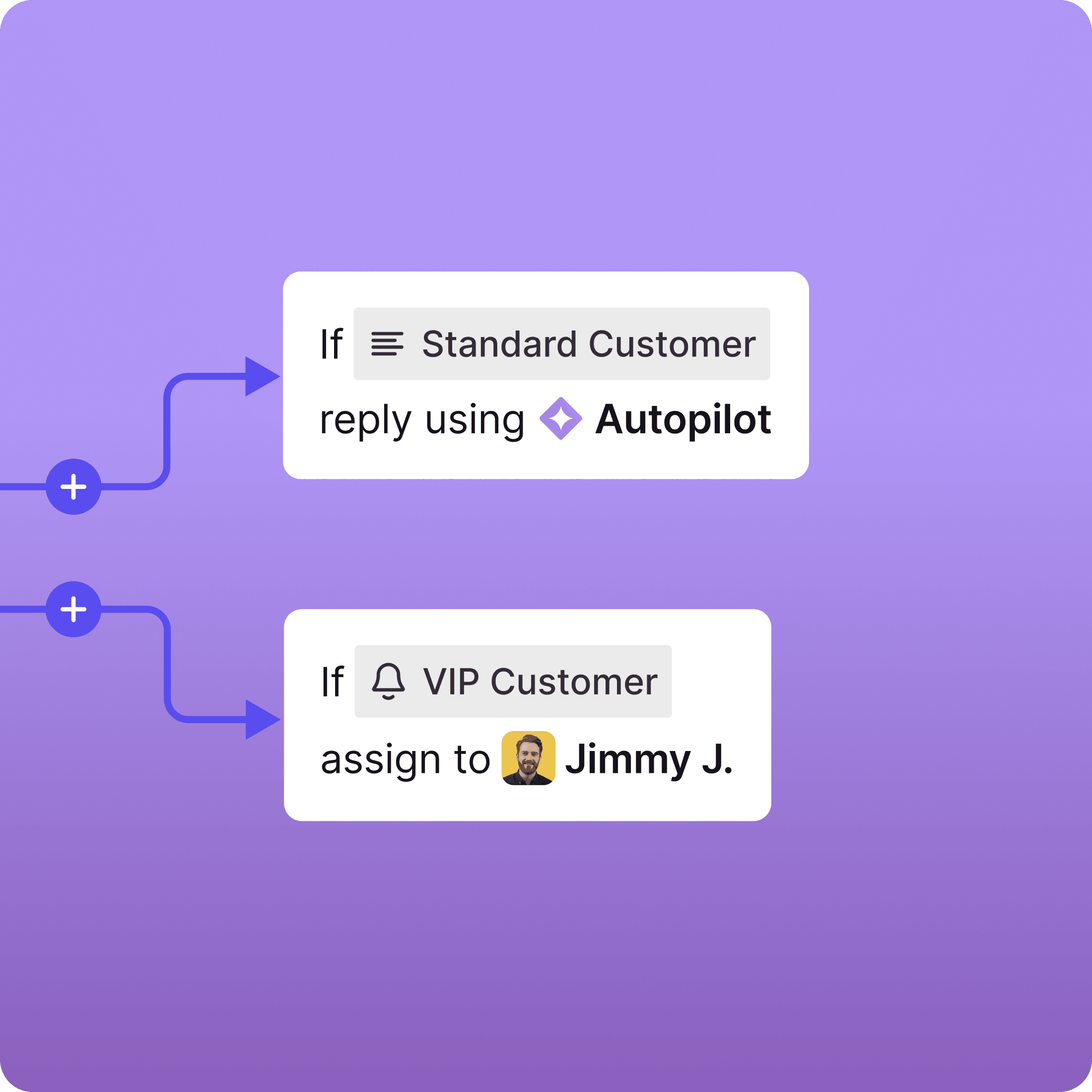

Automate routine steps while staying in control of decisions and handoffs.

Keep freight moving smoothly as volume increases and coordination demands rise.

Turn your inbox into an AI command center built for freight

End the distribution group and shared inbox chaos

Design AI workflows that dominate complex SOPs

Share information and hand off work without the Cc: chaos

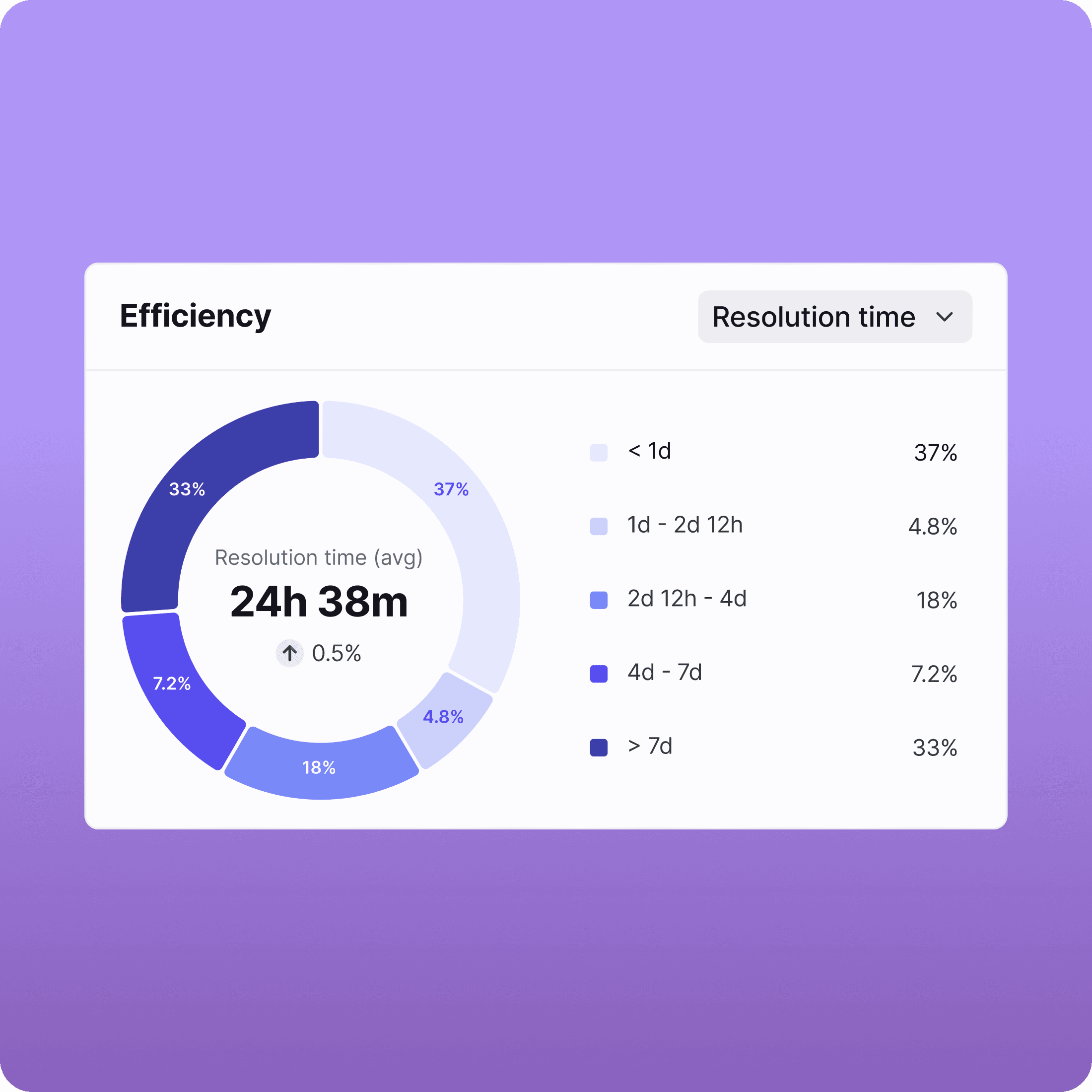

Uncover key insights your inbox is keeping from you

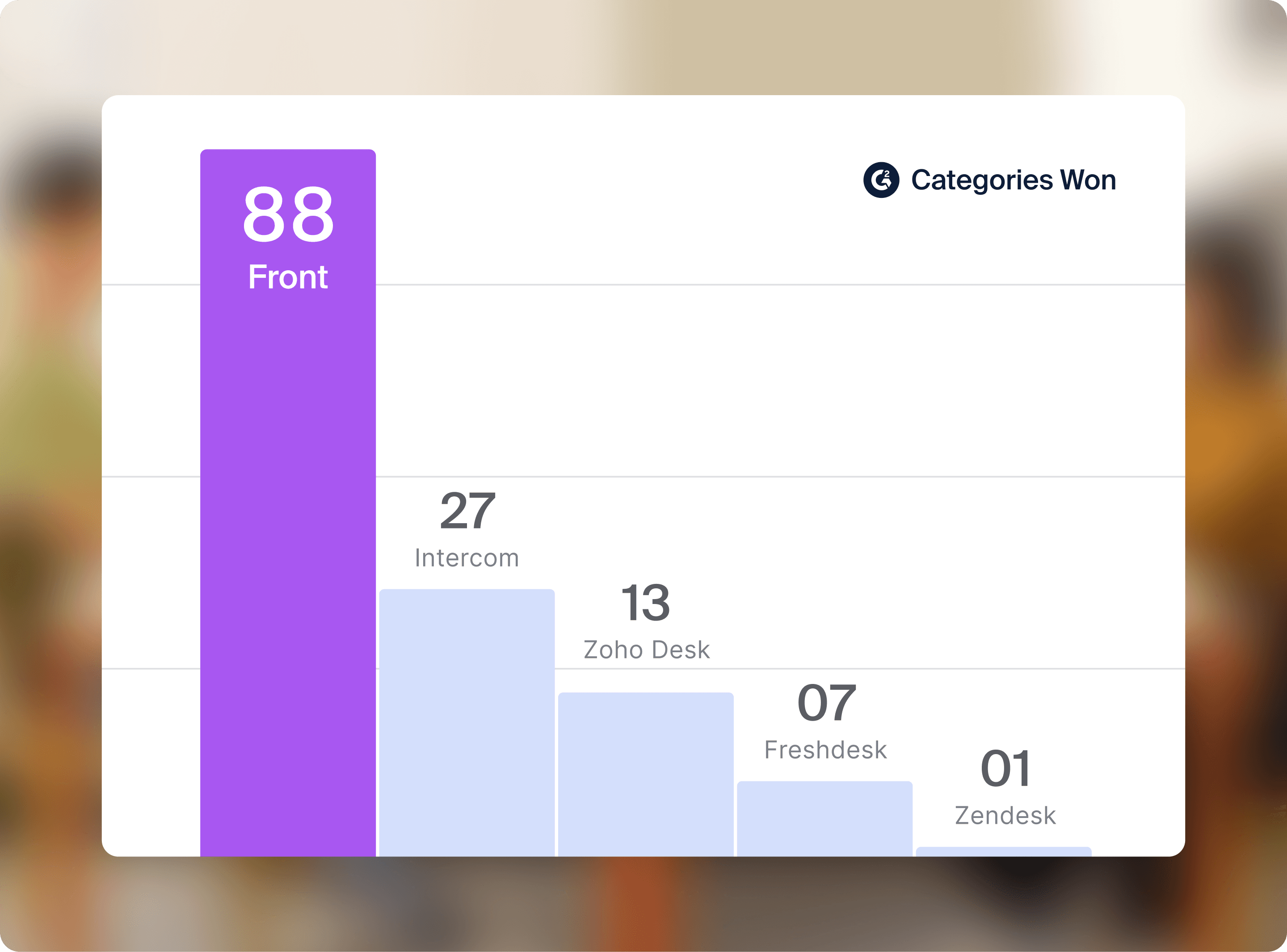

Their AI can chat.

Front AI can run a business.

Front’s AI doesn’t just reply. It runs the operation. G2 proves who’s built for complex work.

The only platform built to run customer operations across teams and tools

Jordan Dunn, Director, Strategic Customer Success

How real companies run work that spans teams

Eliminate inbox chaos and keep freight moving